|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Top Refinance Companies: A Comprehensive GuideRefinancing your mortgage can be a smart financial move, especially when you're looking to save on interest or lower your monthly payments. Choosing the right refinance company is crucial to ensure you get the best deal possible. This guide will explore some of the top refinance companies and what they offer. Why Consider Refinancing?Refinancing can help you achieve financial goals by reducing your interest rate, changing your loan term, or accessing your home equity. It's a strategic decision that can significantly impact your financial health. Benefits of Refinancing

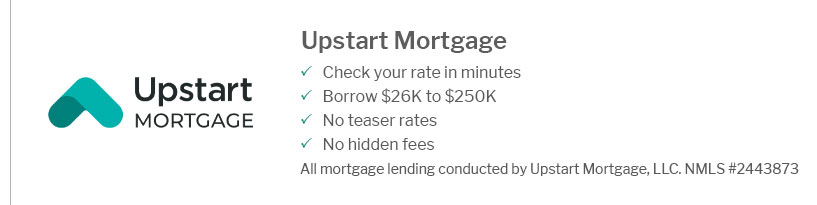

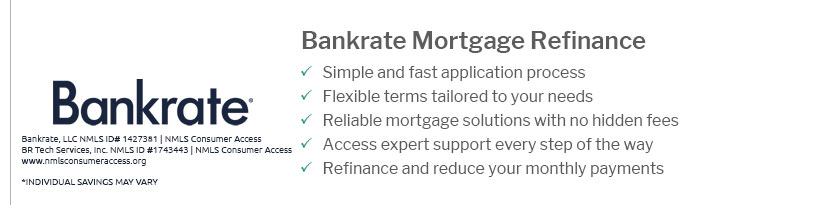

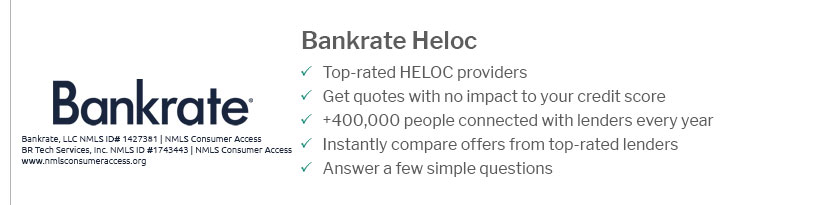

Top Refinance CompaniesLet's delve into some of the leading refinance companies that have consistently provided excellent service and competitive rates. 1. Quicken LoansQuicken Loans, known for its Rocket Mortgage product, offers a seamless online experience with urgent home loan approval processes and personalized customer service. 2. LoanDepotLoanDepot is renowned for its wide range of loan products and exceptional customer support. They offer competitive rates and a user-friendly application process. 3. Wells FargoWells Fargo provides an array of refinancing options, catering to both new and existing customers with enticing offers and flexible terms. Factors to Consider When Choosing a Refinance CompanyWhile interest rates are a major consideration, other factors like customer service, application process, and loan options are also important. Interest RatesAlways compare the current apr mortgage rates across different lenders to ensure you're getting the best deal. Customer ServiceResponsive and knowledgeable customer service can make the refinancing process much smoother and stress-free. FAQs About Refinancing

In conclusion, selecting the right refinance company requires careful consideration of several factors. By evaluating your financial goals and comparing different offers, you can choose the best option that aligns with your needs. https://finance.yahoo.com/personal-finance/mortgages/article/best-cash-out-refinance-lenders-134200722.html

Truist is a mortgage provider that leaves little to be desired. It offers lots of cash-out refi choices and lower-than-median loan costs. https://www.creditkarma.com/home-loans/i/best-mortgage-refinance-companies

We've rounded up our picks of the best mortgage refinance companies based on factors such as loan options, application process, closing timeline, rate matching. https://www.credible.com/mortgage/best-cash-out-refinance-lenders

The best cash-out refinance lenders offer competitive rates, a great customer experience, and several other benefits.

|

|---|